TEANECK, N.J., Feb. 3, 2021 /PRNewswire/ -- Cognizant (Nasdaq: CTSH), one of the world's leading professional services companies, today announced its fourth quarter and full year 2020 financial results.

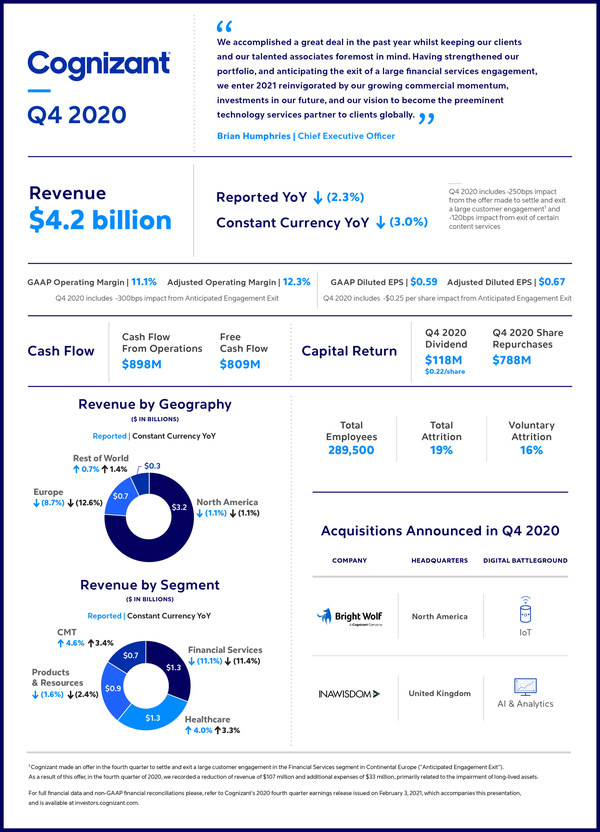

"We accomplished a great deal in the past year whilst keeping our clients and our talented associates foremost in mind," said Brian Humphries, Chief Executive Officer. "Having strengthened our portfolio, and anticipating the exit of a large financial services engagement, we enter 2021 reinvigorated by our growing commercial momentum, investments in our future, and our vision to become the preeminent technology services partner to clients globally."

|

($ in billions) |

Impact of the |

|||||||||||

|

Revenue |

Y/Y % |

Y/Y CC % |

Anticipated Exit |

Exit of Certain |

||||||||

|

Q4 2020 |

$4.2 |

(2.3) |

% |

(3.0) |

% |

(250 bps) |

(120 bps) |

|||||

|

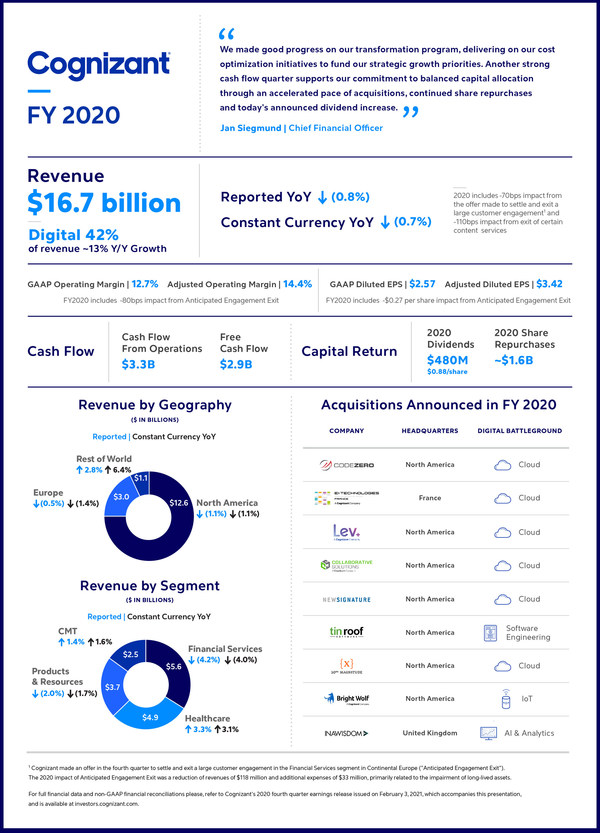

Full Year 2020 |

$16.7 |

(0.8) |

% |

(0.7) |

% |

(70 bps) |

(110 bps) |

|||||

|

Q4 2020 |

Impact of the |

Q4 2019 |

FY2020 |

Impact of the |

FY2019 |

|||||||||||

|

GAAP operating margin |

11.1 |

% |

(300 bps) |

14.6 |

% |

12.7 |

% |

(80 bps) |

14.6 |

% |

||||||

|

Adjusted Operating Margin1 |

12.3 |

% |

17.0 |

% |

14.4 |

% |

16.6 |

% |

||||||||

|

GAAP diluted EPS |

$0.59 |

($0.25) |

$0.72 |

$2.57 |

($0.27) |

$3.29 |

||||||||||

|

Adjusted Diluted EPS1 |

$0.67 |

$1.07 |

$3.42 |

$3.99 |

||||||||||||

Fourth Quarter 2020 Performance by Business Segment

Financial Services (31.2% of revenues) revenue decreased 11.1% year-over-year, or 11.4% in constant currency, driven by declines in both banking and insurance. Growth in regional banks and retail banking was offset by the anticipated exit from a customer engagement, which negatively impacted our revenues in this segment by 730 basis points.

Cognizant made an offer in the fourth quarter to settle and exit a large customer engagement in the financial services segment in Continental Europe. The offer includes, among other terms, a proposed one-time payment and forgiveness of certain receivables. As a result of this offer, in the fourth quarter of 2020, we recorded a reduction of revenue of $107 million and additional expenses of $33 million, primarily related to the impairment of long-lived assets.

Healthcare (30.3% of revenues) revenue grew 4.0% year-over-year, or 3.3% in constant currency, driven by growth in both healthcare and life sciences. Performance in healthcare improved, driven by strength in payer clients and software license sales. Within life sciences, strength in pharmaceutical clients was partially offset by weakness in medical device clients.

Products and Resources (22.7% of revenues) revenue decreased 1.6% year-over-year, or 2.4% in constant currency. The decline was driven by retail, consumer goods, travel and hospitality clients that were particularly adversely affected by the pandemic, partially offset by double-digit constant currency growth in manufacturing, logistics, energy and utilities.

Communications, Media and Technology (15.8% of revenues) revenue increased 4.6% year-over-year, or 3.4% in constant currency, including a negative 790 basis point impact from our exit of certain content-related services, driven by double-digit constant currency growth in both technology and communications and media, which benefited from our recent acquisitions.

"We made good progress on our transformation program, delivering on our cost optimization initiatives to fund our strategic growth priorities," said Jan Siegmund, Chief Financial Officer. "Another strong cash flow quarter supports our commitment to balanced capital allocation through an accelerated pace of acquisitions, continued share repurchases and today's announced dividend increase."

First Quarter and Full Year 2021 Outlook

The Company is providing the following guidance:

- First quarter revenue expected to be $4.34-$4.38 billion, or growth of 2.8-3.8% (1.0-2.0% in CC). This assumes an estimated positive 180 basis points foreign exchange impact and a negative 85 basis points impact from the exit of certain content services

- Full year 2021 revenue expected to be $17.6-$18.1 billion, or growth of 5.5-8.5% (4.0-7.0% in CC). This assumes an estimated positive 150 basis points foreign exchange impact and a negative 30 basis points impact from the exit of certain content services

- Full year 2021 Adjusted Operating Margin2 15.2-16.2%

- Full year 2021 Adjusted Diluted EPS2 expected to be in the range of $3.90-$4.02

Return of Capital to Shareholders

In December 2020, as part of its ongoing balanced capital allocation strategy, the Company increased its share repurchase authorization by $2 billion. In February 2021, the Company declared a quarterly cash dividend of $0.24 per share, a 9% increase, for shareholders of record on February 18, 2021. This dividend will be payable on February 26, 2021.

Conference Call

Cognizant will host a conference call on February 3, 2021, at 5:00 p.m. (Eastern) to discuss the Company's fourth quarter and full year 2020 results. To listen to the conference call, please dial (877) 810-9510 (domestically) or +1 (201) 493-6778 (internationally) and provide the following conference passcode: "Cognizant Call."

The conference call will also be available live on the Investor Relations section of the Cognizant website at http://investors.cognizant.com. An earnings supplement will also be available on the Cognizant website at the time of the conference call.

For those who cannot access the live broadcast, a replay will be available. To listen to the replay, please dial (877) 660-6853 (domestically) or (201) 612-7415 (internationally) and enter 13715007 from two hours after the end of the call until 11:59 p.m. (Eastern) on Wednesday, February 17, 2021. The replay will also be available at Cognizant's website www.cognizant.com for 60 days following the call.

|

_____________ |

|

1 Free cash flow, constant currency ("CC") revenue growth, Adjusted Operating Margin and Adjusted Diluted Earnings Per Share ("Adjusted Diluted EPS") are not measures of financial performance prepared in accordance with GAAP. See "About Non-GAAP Financial Measures and Performance Metrics" for more information and, where applicable, reconciliations to the most directly comparable GAAP financial measures at the end of this release. |

|

2A full reconciliation of Adjusted Operating Margin and Adjusted Diluted EPS guidance to the corresponding GAAP measure on a forward-looking basis cannot be provided without unreasonable efforts, as we are unable to provide reconciling information with respect to unusual items. See "About Non-GAAP Financial Measures and Performance Metrics" for more information and a partial reconciliation at the end of this release. |

About Cognizant

Cognizant (Nasdaq-100: CTSH) is one of the world's leading professional services companies, transforming clients' business, operating and technology models for the digital era. Our unique industry-based, consultative approach helps clients envision, build and run more innovative and efficient businesses. Headquartered in the U.S., Cognizant is ranked 194 on the Fortune 500 and is consistently listed among the most admired companies in the world. Learn how Cognizant helps clients lead with digital at www.cognizant.com or follow us @Cognizant.

Forward-Looking Statements

This press release includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the accuracy of which are necessarily subject to risks, uncertainties, and assumptions as to future events that may not prove to be accurate. These statements include, but are not limited to, express or implied forward-looking statements relating to our expectations regarding the impact of the COVID-19 pandemic on our business,

opportunities in the marketplace, our cost structure, investment in and growth of our business, our realignment plans, the impact of the 2020 Fit for Growth Plan, the likelihood and potential terms of any settlement of and exit from our referenced large customer engagement in the financial services segment, our and our clients' shift to digital solutions and services and our anticipated financial performance. These statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Factors that could cause actual results to differ materially from those expressed or implied include general economic conditions, legal, reputational and financial risks resulting from cyberattacks, the impact of and effectiveness of business continuity plans during the COVID-19 pandemic, changes in the regulatory environment, including with respect to immigration and taxes, and the other factors discussed in our most recent Annual Report on Form 10-K, as updated by our most recent Quarterly Report on Form 10-Q, and other filings with the Securities and Exchange Commission. Cognizant undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law.

About Non-GAAP Financial Measures and Performance Metrics

To supplement our financial results presented in accordance with GAAP, this press release includes references to the following measures defined by the Securities and Exchange Commission as non-GAAP financial measures: Adjusted Income From Operations, Adjusted Operating Margin, Adjusted Diluted EPS, free cash flow, net cash and constant currency revenue growth. These non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP financial measures should be read in conjunction with our financial statements prepared in accordance with GAAP. The reconciliations of our non-GAAP financial measures to the corresponding GAAP measures should be carefully evaluated.

Our non-GAAP financial measures, Adjusted Operating Margin, Adjusted Income From Operations and Adjusted Diluted EPS exclude unusual items. Additionally, Adjusted Diluted EPS excludes net non-operating foreign currency exchange gains or losses and the tax impact of all the applicable adjustments. The income tax impact of each item is calculated by applying the statutory rate and local tax regulations in the jurisdiction in which the item was incurred. Free cash flow is defined as cash flows from operating activities net of purchases of property and equipment. Net cash is defined as cash and cash equivalents and short-term investments less short-term and long-term debt. Constant currency revenue growth is defined as revenues for a given period restated at the comparative period's foreign currency exchange rates measured against the comparative period's reported revenues.

Management believes providing investors with an operating view consistent with how we manage the Company provides enhanced transparency into our operating results. For our internal management reporting and budgeting purposes, we use various GAAP and non-GAAP financial measures for financial and operational decision-making, to evaluate period-to-period comparisons, to determine portions of the compensation for our executive officers and for making comparisons of our operating results to those of our competitors. Therefore, it is our belief that the use of non-GAAP financial measures excluding certain costs provides a meaningful supplemental measure for investors to evaluate our financial performance. Accordingly, we believe that the presentation of our non-GAAP measures, when read in conjunction with our reported GAAP results, can provide useful supplemental information to our management and investors regarding financial and business trends relating to our financial condition and results of operations.

A limitation of using non-GAAP financial measures versus financial measures calculated in accordance with GAAP is that non-GAAP financial measures do not reflect all of the amounts associated with our operating results as determined in accordance with GAAP and may exclude costs that are recurring such as our net non-operating foreign currency exchange gains or losses. In addition, other companies may calculate non-GAAP financial measures differently than us, thereby limiting the usefulness of these non-GAAP financial measures as a comparative tool. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from our non-GAAP financial measures to allow investors to evaluate such non-GAAP financial measures.

Bookings are defined as total contract value (or TCV) of new contracts, including new contract sales as well as renewals and expansions of existing contracts. Bookings can vary significantly quarter to quarter depending in part on the timing of the signing of a small number of large contracts. Measuring bookings involves the use of estimates and judgments and there are no third-party standards or requirements governing the calculation of bookings. The extent and timing of conversion of bookings to revenues may be impacted by, among other factors, the types of services and solutions sold, contract duration, the pace of client spending, actual volumes of services delivered as compared to the volumes anticipated at the time of sale, and contract modifications, including terminations, over the lifetime of a contract. The majority of our contracts are terminable by the client on short notice often without penalty, and some without notice. We do not update our bookings for material subsequent terminations or reductions related to bookings originally recorded in prior year periods or foreign currency exchange rate fluctuations. Information regarding our bookings is not comparable to, nor should it be substituted for, an analysis of our reported revenues. However, management believes that it is a key indicator of potential future revenues and provides a useful indicator of the volume of our business over time.

|

Investor Relations Contact: |

Media Contact: |

|||

|

Katie Royce |

Jeff DeMarrais |

|||

|

Global Head of Investor Relations |

VP, Corporate Communications |

|||

|

201-679-2739 |

475-223-2298 |

|||

|

Katie.Royce@cognizant.com |

Jeff.DeMarrais@cognizant.com |

|||

|

- tables to follow - |

||||

|

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION |

|||||||||||||||

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|||||||||||||||

|

(Unaudited) |

|||||||||||||||

|

(in millions, except per share data) |

|||||||||||||||

|

Three Months Ended |

Twelve Months Ended |

||||||||||||||

|

2020 |

2019 |

2020 |

2019 |

||||||||||||

|

Revenues |

$ |

4,184 |

$ |

4,284 |

$ |

16,652 |

$ |

16,783 |

|||||||

|

Operating expenses: |

|||||||||||||||

|

Cost of revenues (exclusive of depreciation and amortization expense |

2,662 |

2,749 |

10,671 |

10,634 |

|||||||||||

|

Selling, general and administrative expenses |

874 |

676 |

3,100 |

2,972 |

|||||||||||

|

Restructuring charges |

38 |

101 |

215 |

217 |

|||||||||||

|

Depreciation and amortization expense |

145 |

132 |

552 |

507 |

|||||||||||

|

Income from operations |

465 |

626 |

2,114 |

2,453 |

|||||||||||

|

Other income (expense), net: |

|||||||||||||||

|

Interest income |

14 |

40 |

119 |

176 |

|||||||||||

|

Interest expense |

(3) |

(6) |

(24) |

(26) |

|||||||||||

|

Foreign currency exchange gains (losses), net |

(11) |

(36) |

(116) |

(65) |

|||||||||||

|

Other, net |

2 |

2 |

3 |

5 |

|||||||||||

|

Total other income (expense), net |

2 |

— |

(18) |

90 |

|||||||||||

|

Income before provision for income taxes |

467 |

626 |

2,096 |

2,543 |

|||||||||||

|

Provision for income taxes |

(152) |

(174) |

(704) |

(643) |

|||||||||||

|

Income (loss) from equity method investment |

1 |

(57) |

— |

(58) |

|||||||||||

|

Net income |

$ |

316 |

$ |

395 |

$ |

1,392 |

$ |

1,842 |

|||||||

|

Basic earnings per share |

$ |

0.59 |

$ |

0.72 |

$ |

2.58 |

$ |

3.30 |

|||||||

|

Diluted earnings per share |

$ |

0.59 |

$ |

0.72 |

$ |

2.57 |

$ |

3.29 |

|||||||

|

Weighted average number of common shares outstanding - Basic |

533 |

548 |

540 |

559 |

|||||||||||

|

Dilutive effect of shares issuable under stock-based compensation plans |

1 |

— |

1 |

1 |

|||||||||||

|

Weighted average number of common shares outstanding - Diluted |

534 |

548 |

541 |

560 |

|||||||||||

|

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION |

|||||||

|

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION |

|||||||

|

(Unaudited) |

|||||||

|

(in millions, except par values) |

|||||||

|

December 31, |

December 31, |

||||||

|

Assets |

|||||||

|

Current assets: |

|||||||

|

Cash and cash equivalents |

$ |

2,680 |

$ |

2,645 |

|||

|

Short-term investments |

44 |

779 |

|||||

|

Trade accounts receivable, net |

3,087 |

3,256 |

|||||

|

Other current assets |

1,040 |

931 |

|||||

|

Total current assets |

6,851 |

7,611 |

|||||

|

Property and equipment, net |

1,251 |

1,309 |

|||||

|

Operating lease assets, net |

1,013 |

926 |

|||||

|

Goodwill |

5,031 |

3,979 |

|||||

|

Intangible assets, net |

1,046 |

1,041 |

|||||

|

Deferred income tax assets, net |

445 |

585 |

|||||

|

Long-term investments |

440 |

17 |

|||||

|

Other noncurrent assets |

846 |

736 |

|||||

|

Total assets |

$ |

16,923 |

$ |

16,204 |

|||

|

Liabilities and Stockholders' Equity |

|||||||

|

Current liabilities: |

|||||||

|

Accounts payable |

$ |

389 |

$ |

239 |

|||

|

Deferred revenue |

383 |

313 |

|||||

|

Short-term debt |

38 |

38 |

|||||

|

Operating lease liabilities |

211 |

202 |

|||||

|

Accrued expenses and other current liabilities |

2,519 |

2,191 |

|||||

|

Total current liabilities |

3,540 |

2,983 |

|||||

|

Deferred revenue, noncurrent |

36 |

23 |

|||||

|

Operating lease liabilities, noncurrent |

846 |

745 |

|||||

|

Deferred income tax liabilities, net |

206 |

35 |

|||||

|

Long-term debt |

663 |

700 |

|||||

|

Long-term income taxes payable |

428 |

478 |

|||||

|

Other noncurrent liabilities |

368 |

218 |

|||||

|

Total liabilities |

6,087 |

5,182 |

|||||

|

Stockholders' equity: |

|||||||

|

Preferred stock, $0.10 par value, 15 shares authorized, none issued |

— |

— |

|||||

|

Class A common stock, $0.01 par value, 1,000 shares authorized, 530 and 548 shares issued and |

5 |

5 |

|||||

|

Additional paid-in capital |

32 |

33 |

|||||

|

Retained earnings |

10,689 |

11,022 |

|||||

|

Accumulated other comprehensive income (loss) |

110 |

(38) |

|||||

|

Total stockholders' equity |

10,836 |

11,022 |

|||||

|

Total liabilities and stockholders' equity |

$ |

16,923 |

$ |

16,204 |

|||

|

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION |

|||||||||||||||||

|

Reconciliations of Non-GAAP Financial Measures |

|||||||||||||||||

|

(Unaudited) |

|||||||||||||||||

|

(dollars in millions, except per share amounts) |

|||||||||||||||||

|

Three Months Ended |

Twelve Months Ended |

Guidance |

|||||||||||||||

|

2020 |

2019 |

2020 |

2019 |

Full Year 2021 |

|||||||||||||

|

GAAP income from operations |

$ |

465 |

$ |

626 |

$ |

2,114 |

$ |

2,453 |

|||||||||

|

Realignment charges(a) |

2 |

53 |

42 |

169 |

|||||||||||||

|

2020 Fit for Growth Plan restructuring charges(b) |

36 |

48 |

173 |

48 |

|||||||||||||

|

COVID-19 charges(c) |

13 |

— |

65 |

— |

|||||||||||||

|

Incremental accrual related to the India Defined |

— |

— |

— |

117 |

|||||||||||||

|

Adjusted Income From Operations |

$ |

516 |

$ |

727 |

$ |

2,394 |

$ |

2,787 |

|||||||||

|

GAAP operating margin |

11.1 |

% |

14.6 |

% |

12.7 |

% |

14.6 |

% |

|||||||||

|

Realignment charges |

— |

1.3 |

0.3 |

1.0 |

— |

||||||||||||

|

2020 Fit for Growth Plan restructuring charges |

0.9 |

1.1 |

1.0 |

0.3 |

— |

||||||||||||

|

COVID-19 charges |

0.3 |

— |

0.4 |

— |

— |

||||||||||||

|

Incremental accrual related to the India Defined |

— |

— |

— |

0.7 |

(d) |

||||||||||||

|

Adjusted Operating Margin |

12.3 |

% |

17.0 |

% |

14.4 |

% |

16.6 |

% |

15.2% - 16.2% |

||||||||

|

GAAP diluted earnings per share |

$ |

0.59 |

$ |

0.72 |

$ |

2.57 |

$ |

3.29 |

|||||||||

|

Effect of above adjustments to income from |

0.10 |

0.18 |

0.52 |

0.60 |

(d) |

||||||||||||

|

Non-operating foreign currency exchange (gains) |

0.02 |

0.08 |

0.22 |

0.11 |

(e) |

||||||||||||

|

Tax effect of above adjustments(f) |

(0.04) |

(0.05) |

(0.15) |

(0.15) |

(d),(e) |

||||||||||||

|

Tax on Accumulated Indian Earnings(g) |

— |

— |

0.26 |

— |

— |

||||||||||||

|

Effect of the equity method investment impairment(h) |

— |

0.10 |

— |

0.10 |

— |

||||||||||||

|

Effect of the India Tax Law(i) |

— |

0.04 |

— |

0.04 |

— |

||||||||||||

|

Adjusted Diluted Earnings Per Share |

$ |

0.67 |

$ |

1.07 |

$ |

3.42 |

$ |

3.99 |

$3.90 - $4.02 |

||||||||

|

Notes: |

|

|

(a) |

Realignment charges include: |

|

Three Months Ended |

Twelve Months Ended |

||||||||||||||||

|

2020 |

2019 |

2020 |

2019 |

||||||||||||||

|

(in millions) |

|||||||||||||||||

|

Employee separation costs |

$ |

— |

$ |

4 |

$ |

— |

$ |

64 |

|||||||||

|

Executive transition costs |

— |

— |

— |

22 |

|||||||||||||

|

Employee retention costs |

— |

27 |

15 |

45 |

|||||||||||||

|

Professional fees |

2 |

22 |

27 |

38 |

|||||||||||||

|

Total realignment charges |

$ |

2 |

$ |

53 |

$ |

42 |

$ |

169 |

|||||||||

|

Executive transition costs are costs associated with our CEO transition and the departure of our President in 2019. The total costs related to the realignment program are reported in "Restructuring charges" in our consolidated statement of operations. We do not expect to incur additional costs related to this plan. |

|

|

(b) |

2020 Fit for Growth Plan restructuring charges include: |

|

Three Months Ended |

Twelve Months Ended |

||||||||||||||||

|

2020 |

2019 |

2020 |

2019 |

||||||||||||||

|

(in millions) |

|||||||||||||||||

|

Employee separation costs |

$ |

24 |

$ |

45 |

$ |

127 |

$ |

45 |

|||||||||

|

Employee retention costs |

— |

2 |

5 |

2 |

|||||||||||||

|

Facility exit costs and other charges |

12 |

1 |

41 |

1 |

|||||||||||||

|

Total 2020 Fit For Growth charges |

$ |

36 |

$ |

48 |

$ |

173 |

$ |

48 |

|||||||||

|

These charges include $3 million and $23 million for the three months and the year ended December 31, 2020, respectively, of costs incurred related to our exit from certain content-related services as compared to $5 million for both the three months and the year ended December 31, 2019. The total costs related to the 2020 Fit for Growth Plan are reported in "Restructuring charges" in our consolidated statements of operations. We do not expect to incur additional costs related to this plan. |

|

|

(c) |

During 2020, we incurred costs in response to the COVID-19 pandemic, including a one-time bonus to our employees at the designation of associate and below in both India and the Philippines, certain costs to enable our employees to work remotely, and provide medical staff and extra cleaning services for our facilities. Most of the costs related to the pandemic are reported in "Cost of revenues" in our consolidated statement of operations. |

|

(d) |

During the first quarter of 2019, a ruling of the Supreme Court of India interpreting certain statutory defined contribution obligations of employees and employers (the "India Defined Contribution Obligation") altered historical understandings of such obligations, extending them to cover additional portions of the employee's income. As a result, the ongoing contributions of our affected employees and the Company have increased. In the first quarter of 2019, we accrued $117 million with respect to prior periods, assuming retroactive application of the Supreme Court's ruling. There is significant uncertainty as to how the liability should be calculated as it is impacted by multiple variables, including the period of assessment, the application with respect to certain current and former employees and whether interest and penalties may be assessed. Since the ruling, a variety of trade associations and industry groups have advocated to the Indian government, highlighting the harm to the information technology sector, other industries and job growth in India that would result from a retroactive application of the ruling. It is possible that the Indian government will review the matter and there is a substantial question as to whether the Indian government will apply the Supreme Court's ruling on a retroactive basis. As such, the ultimate amount of our obligation may be materially different from the amount accrued. The incremental accrual related to the India Defined Contribution Obligation is reported in "Selling, general and administrative expenses" in our consolidated statement of operations. |

|

(e) |

Non-operating foreign currency exchange gains and losses, inclusive of gains and losses on related foreign exchange forward contracts not designated as hedging instruments for accounting purposes, are reported in "Foreign currency exchange gains (losses), net" in our consolidated statements of operations. Non-operating foreign currency exchange gains and losses are subject to high variability and low visibility and therefore cannot be provided on a forward-looking basis without unreasonable efforts. |

|

(f) |

Presented below are the tax impacts of each of our non-GAAP adjustments to pre-tax income: |

|

Three Months Ended |

Twelve Months Ended |

||||||||||||||||

|

2020 |

2019 |

2020 |

2019 |

||||||||||||||

|

(in millions) |

(in millions) |

||||||||||||||||

|

Non-GAAP income tax benefit (expense) related to: |

|||||||||||||||||

|

Realignment charges |

$ |

1 |

$ |

13 |

$ |

11 |

$ |

43 |

|||||||||

|

2020 Fit For Growth plan restructuring charges |

9 |

13 |

45 |

13 |

|||||||||||||

|

COVID-19 charges |

3 |

— |

17 |

— |

|||||||||||||

|

Incremental accrual related to the India Defined Contribution Obligation |

— |

— |

— |

31 |

|||||||||||||

|

Foreign currency exchange gains and losses |

9 |

— |

6 |

(1) |

|||||||||||||

|

The effective tax rate related to each of our non-GAAP adjustments varies depending on the jurisdictions in which such income and expenses are generated and the statutory rates applicable in those jurisdictions. |

|

|

(g) |

During the third quarter of 2020, after a thorough analysis of the impact of several changes in tax law on the cost of earnings repatriation and considering our strategic decision to increase our investments to accelerate growth in various international markets and expand our global delivery footprint, we reversed our indefinite reinvestment assertion on Indian earnings accumulated in prior years and recorded a $140 million Tax on Accumulated Indian Earnings. The recorded income tax expense reflects the India withholding tax on unrepatriated Indian earnings, which were $5.2 billion as of December 31, 2019, net of applicable U.S. foreign tax credits. |

|

(h) |

During the fourth quarter of 2019, we determined that the carrying value of one of our equity method investments exceeded its fair value and therefore recorded an impairment charge of $57 million within the caption "Income (loss) from equity method investments" in our consolidated statement of operations. |

|

(i) |

During the fourth quarter of 2019, the Government of India enacted a new tax regime ("India Tax Law") effective retroactively to April 2019 that enables domestic companies to elect to be taxed at a lower income tax rate of 25.17%, as compared to the current income tax rate of 34.94%. Once a company elects into the lower income tax rate, a company may not benefit from any tax holidays associated with Special Economic Zones and certain other tax incentives, including Minimum Alternative Tax credit carryforwards, and may not reverse its election. As a result of the enactment of the India Tax Law, we recorded a one-time net income tax expense of $21 million due to the revaluation to the lower income tax rate of our India net deferred income tax assets that we expected to reverse after we expected to elect into the new tax regime. |

|

Reconciliations of net cash |

||||||||||

|

(in millions) |

||||||||||

|

December 31, 2020 |

December 31, 2019 |

|||||||||

|

Cash and cash equivalents |

$ |

2,680 |

$ |

2,645 |

||||||

|

Short-term investments(a) |

44 |

779 |

||||||||

|

Less: |

||||||||||

|

Short-term debt |

38 |

38 |

||||||||

|

Long-term debt |

663 |

700 |

||||||||

|

Net cash |

$ |

2,023 |

$ |

2,686 |

||||||

|

Notes: |

|

|

(a) |

As of December 31, 2019, $414 million in restricted time deposits were classified as short-term investments. As of December 31, 2020, the restricted deposits in the amount of $405 million were classified as long-term investments and therefore were not included in net cash as of that date. |

|

The above tables serve to reconcile the Non-GAAP financial measures to the most directly comparable GAAP measures. Refer to the "About Non-GAAP Financial Measures" section of our press release for further information on the use of these Non-GAAP measures. |

|

|

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION |

||||||||||||

|

Revenue by Business Segment and Geography |

||||||||||||

|

(Unaudited) |

||||||||||||

|

(dollars in millions) |

||||||||||||

|

Three Months Ended December 31, 2020 |

||||||||||||

|

Year over Year |

||||||||||||

|

$ |

% of total |

% Change |

Constant |

|||||||||

|

Revenues by Segment: |

||||||||||||

|

Financial Services (b) |

$ |

1,305 |

31.2 |

% |

(11.1) |

% |

(11.4) |

% |

||||

|

Healthcare |

1,270 |

30.3 |

% |

4.0 |

% |

3.3 |

% |

|||||

|

Products and Resources |

948 |

22.7 |

% |

(1.6) |

% |

(2.4) |

% |

|||||

|

Communications, Media and Technology (c) |

661 |

15.8 |

% |

4.6 |

% |

3.4 |

% |

|||||

|

Total Revenues |

$ |

4,184 |

(2.3) |

% |

(3.0) |

% |

||||||

|

Revenues by Geography: |

||||||||||||

|

North America |

$ |

3,206 |

76.6 |

% |

(1.1) |

% |

(1.1) |

% |

||||

|

United Kingdom |

339 |

8.1 |

% |

0.6 |

% |

(2.3) |

% |

|||||

|

Continental Europe (b) |

360 |

8.6 |

% |

(16.1) |

% |

(20.7) |

% |

|||||

|

Europe - Total |

699 |

16.7 |

% |

(8.7) |

% |

(12.6) |

% |

|||||

|

Rest of World |

279 |

6.7 |

% |

0.7 |

% |

1.4 |

% |

|||||

|

Total Revenues |

$ |

4,184 |

(2.3) |

% |

(3.0) |

% |

||||||

|

Twelve Months Ended December 31, 2020 |

||||||||||||

|

Year over Year |

||||||||||||

|

$ |

% of total |

% Change |

Constant |

|||||||||

|

Revenues by Segment: |

||||||||||||

|

Financial Services (b) |

$ |

5,621 |

33.8 |

% |

(4.2) |

% |

(4.0) |

% |

||||

|

Healthcare |

4,852 |

29.1 |

% |

3.3 |

% |

3.1 |

% |

|||||

|

Products and Resources |

3,696 |

22.2 |

% |

(2.0) |

% |

(1.7) |

% |

|||||

|

Communications, Media and Technology (c) |

2,483 |

14.9 |

% |

1.4 |

% |

1.6 |

% |

|||||

|

Total Revenues |

$ |

16,652 |

(0.8) |

% |

(0.7) |

% |

||||||

|

Revenues by Geography: |

||||||||||||

|

North America |

$ |

12,581 |

75.6 |

% |

(1.1) |

% |

(1.1) |

% |

||||

|

United Kingdom |

1,335 |

8.0 |

% |

1.7 |

% |

1.0 |

% |

|||||

|

Continental Europe (b) |

1,653 |

9.9 |

% |

(2.2) |

% |

(3.3) |

% |

|||||

|

Europe - Total |

2,988 |

17.9 |

% |

(0.5) |

% |

(1.4) |

% |

|||||

|

Rest of World |

1,083 |

6.5 |

% |

2.8 |

% |

6.4 |

% |

|||||

|

Total Revenues |

$ |

16,652 |

(0.8) |

% |

(0.7) |

% |

||||||

|

Notes: |

|

|

(a) |

Constant currency revenue growth is not a measure of financial performance prepared in accordance with GAAP. See "About Non-GAAP Financial Measures and Performance Metrics" for more information. |

|

(b) |

The anticipated exit from a customer engagement in the Financial Services segment in Continental Europe negatively impacted our revenues by $107 million and $118 million for the quarter and year ended December 31, 2020, respectively. The impact on Financial Services revenue growth was 730 basis points and 200 basis points for the quarter and year ended December 31, 2020, respectively. The impact on Continental Europe revenue growth was 2,490 basis points and 700 basis points for the quarter and year ended December 31, 2020, respectively. |

|

(c) |

Revenues in our Communications, Media and Technology segment were negatively impacted by $50 million, or 790 basis points of growth, for the quarter ended December 31, 2020 and $178 million, or 730 basis points of growth, for the year ended December 31, 2020 by our exit of certain content-related services. |

|

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION |

|||||||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|||||||||||||||

|

(Unaudited) |

|||||||||||||||

|

(in millions) |

|||||||||||||||

|

Three Months Ended |

Twelve Months Ended |

||||||||||||||

|

2020 |

2019 |

2020 |

2019 |

||||||||||||

|

Cash flows from operating activities: |

|||||||||||||||

|

Net income |

$ |

316 |

$ |

395 |

$ |

1,392 |

$ |

1,842 |

|||||||

|

Adjustments for non-cash income and expenses |

108 |

155 |

1,094 |

556 |

|||||||||||

|

Changes in assets and liabilities |

474 |

388 |

813 |

101 |

|||||||||||

|

Net cash provided by operating activities |

898 |

938 |

3,299 |

2,499 |

|||||||||||

|

Cash flows from investing activities: |

|||||||||||||||

|

Purchases of property and equipment |

(89) |

(93) |

(398) |

(392) |

|||||||||||

|

Net sales (purchases) of investments |

94 |

(43) |

283 |

2,597 |

|||||||||||

|

Payments for business combinations, net of cash acquired |

(54) |

(239) |

(1,123) |

(617) |

|||||||||||

|

Net cash (used in) provided by investing activities |

(49) |

(375) |

(1,238) |

1,588 |

|||||||||||

|

Cash flows from financing activities: |

|||||||||||||||

|

Repurchases of common stock |

(788) |

(163) |

(1,621) |

(2,247) |

|||||||||||

|

Repayment of term loan borrowings and finance lease and earnout |

(13) |

(12) |

(50) |

(28) |

|||||||||||

|

Net change in notes outstanding under the revolving credit facility |

(1,740) |

— |

— |

— |

|||||||||||

|

Dividends paid |

(118) |

(110) |

(480) |

(453) |

|||||||||||

|

Issuance of common stock under stock-based compensation plans |

33 |

32 |

142 |

159 |

|||||||||||

|

Net cash (used in) financing activities |

(2,626) |

(253) |

(2,009) |

(2,569) |

|||||||||||

|

Effect of exchange rate changes on cash and cash equivalents |

21 |

(8) |

(17) |

(34) |

|||||||||||

|

(Decrease) increase in cash and cash equivalents |

(1,756) |

302 |

35 |

1,484 |

|||||||||||

|

Cash and cash equivalents, beginning of period |

4,436 |

2,343 |

2,645 |

1,161 |

|||||||||||

|

Cash and cash equivalents, end of period |

$ |

2,680 |

$ |

2,645 |

$ |

2,680 |

$ |

2,645 |

|||||||

|

SUPPLEMENTAL CASH FLOW INFORMATION |

|||||||

|

(in millions) |

|||||||

|

Three Months Ended |

|||||||

|

Stock Repurchases under Board of Directors' authorized stock repurchase program: |

December 31, 2020 |

December 31, 2019 |

|||||

|

Number of shares repurchased |

9.6 |

2.5 |

|||||

|

Remaining authorized balance |

$ |

2,815 |

|||||

|

Reconciliation of Free Cash Flow Non-GAAP Financial Measure |

|||||||||||||||

|

(in millions) |

|||||||||||||||

|

Three Months Ended |

Twelve Months Ended |

||||||||||||||

|

2020 |

2019 |

2020 |

2019 |

||||||||||||

|

Net cash provided by operating activities |

$ |

898 |

$ |

938 |

$ |

3,299 |

$ |

2,499 |

|||||||

|

Purchases of property and equipment |

(89) |

(93) |

(398) |

(392) |

|||||||||||

|

Free cash flow |

$ |

809 |

$ |

845 |

$ |

2,901 |

$ |

2,107 |

|||||||

SOURCE Cognizant